Let’s remember that provisions intend to impact today’s P&L in anticipation of a likely expense in the future. And the answer quite often lies within the accounts included inside net working capital!Ī common example of “non-cash items” are provisions. Your responsibility as a cash flow builder is to understand which one. When EBITDA is impacted by a so-called “non-cash item,” remember that there is always a balance sheet account concomitantly impacted. What people often miss is that NWC and EBITDA should be analyzed together when looking at cash generation. For example, if Company A sold an item for $40 that it purchased for $10 in cash last year, but its customer still has not paid for it, what should you consider “cash EBITDA”? Should it be $30 (revenue less COGS, assuming no other OpEx)? Or should it rather be $0 (considering that the item purchased was paid for last year and no proceeds have been collected yet)? The notion of cash and non-cash can be quite confusing to the uninitiated.

Is the Presentation Representative of Actual Cash Inflows and Outflows? If this is the case, you will need to remove it from NWC and add it to the cash flows from the investing (CFI) section.Īssuming a movement of trade payables on CapEx of +1 between Dec-18 and Dec-19, we would make the following changes to our cash flow statement from the example above:Ģ. It is quite common that this account gets included in the trade payables (in current liabilities) and, as such, gets classified as net working capital. Once analyzed, a discussion with the financial controller, or CFO, can then take place to question any discrepancies of opinion over the correct classification of items.Ī classic example in this scenario is trade payables on CapEx (i.e., outstanding payments due to fixed asset providers). This is quite a forensic exercise that will essentially require you to look over every line account used in your accounting software. To do so, here are a few questions to ask yourself: 1. Now that you have a cash flow statement that links dynamically to the balance sheet, it’s time to dig a bit further. The objective of creating a cash flow format like the one above is to better assess and understand the cash inflows and outflows of the business by their category (e.g., operating, financing, and investing). This is now the part where having classical accounting knowledge will prove useful, although it is not a prerequisite.

#Statement of cash flows sample problems how to#

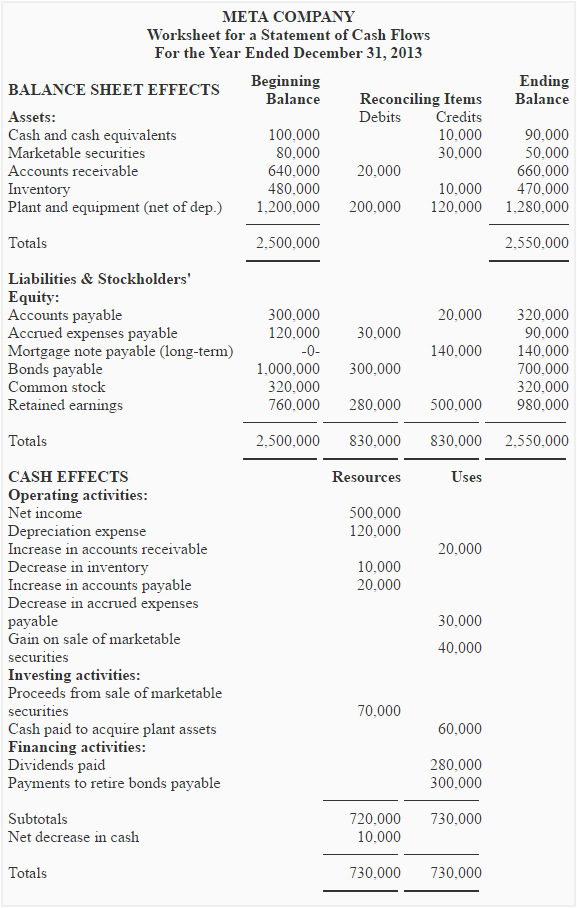

How to Improve Your Cash Flow Statement Processes? It may look straightforward, but each line represents a number of precedent calculations. The latter is the most common method encountered since the direct method requires a granular level of reporting that can prove more cumbersome.īelow is a snapshot of what we aim to achieve. The direct method uses actual cash inflows and outflows from the company’s operations, and the indirect method uses the P&L and balance sheet as a starting point. There are two widespread ways to build a cash flow statement. To help your learning, I have also put together an example spreadsheet which demonstrates the required interconnectivity. I will also explain the interconnectivity between the different lines of the cash flow statement and demonstrate why balance sheet accounts and, in particular, Net Working Capital have a central role in making it all work. All of this can be avoided by following a strict but simple methodology:īuild financial models with correct interconnectivity between the three primary accounting statements: income statement, balance sheet, and P&L.īelow is a step-by-step method to ensure your cash flow always balances and tallies. Second, it creates unnecessary costs arising from the extra work required to dig out the missing pieces, generating extra labor hours on both sides of the transaction. First, it creates doubts and worries in the buyer’s mind: “How can we trust the accuracy of the numbers if different sources give different results?” This can be a dealbreaker or can taper confidence in the team’s ability to execute. I have worked on several financial due diligence projects for M&A deals where data provenance was a problem. When something falls out of line between all these sources, it very quickly causes critical imbalances in a model. The most common reason is the wide range of data sources used by the company: the sales teams’ tracking software, CapEx files maintained by the CFO, and inventory reporting metrics from the procurement team, to name a few. Whether I’m looking at acquisition opportunities at HoriZen Capital or building best practices models, I often see cash flow statements that don’t reconcile with the balance sheet.

#Statement of cash flows sample problems download#

To download the example cash flow statement used throughout this post, click here.

0 kommentar(er)

0 kommentar(er)